So – let’s just start with the good stuff first and get that out of the way, and then we’ll break it down even further where I can be somewhat more critical and nit-picky. I love to share with others all the things that I like about this software. I know isn’t the smartest thing to do if I want to scale up and reach those lofty goals that I have.īreaking down the pros and cons of QuickBooks Self-EmployedĪs I’ve already mentioned, writing this QuickBooks Self-Employed review is pretty easy for me.

It’s my baby, and I feel like I need to have my hand in everything. That says a lot considering how much I like to be in control of everything, because 8 have a really hard time letting go of things – especially when it comes to my business. QuickBooks Self-Employed does all of these things flawlessly, and I couldn’t imagine doing all of this stuff manually. Instantly track and organize expenses on multiple accounts.

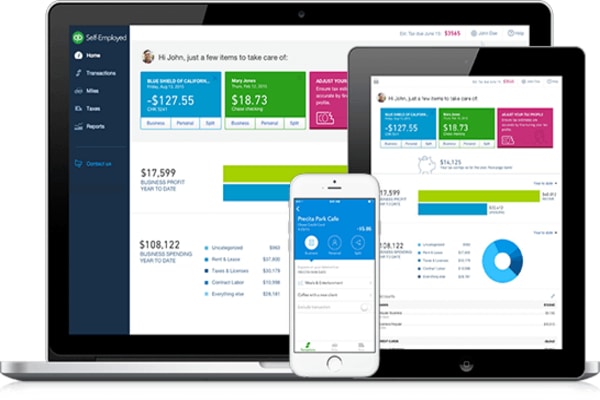

QUICKBOOKS SELF EMPLOYED REVIEW SOFTWARE

When I was on my quest to find software which would help manage my books and keep everything organized for me, I had a list of requirements that were absolutely necessary: I’m going to come out and say right now that yes, it’s totally worth the cost and it’s working perfectly for me and the way that I’ve been running my business.īut let’s back up a little bit first. Chances are if you’re reading this review you are very familiar with all of the other business accounting software out there (there are a lot of them), and you just need a little help to figure out if the Self-Employed version of QuickBooks is worth the monthly subscription price.

To be honest I’m not even really sure how I settled on QuickBooks Self-Employed to begin with. The problem was that keeping track of all my income and expenses (especially for tax purposes) was a turning into a full-time job all in and of itself, so I needed a little help. Never mind the fact that I’ve always been pretty good with my expenses, and the fact that I love statistics and crunching the numbers on things made it somewhat easy for me to transition from being a corporate 9 to 5 employee to someone who is in control of their own financial destiny. One of the most important things that I learned after quitting my job and becoming a full-time blogger was the fact that I needed to find a way to manage all my business related income and expenses if I had any hope of not stabbing my eyes out with a fork.

Sounds good, right? Well, read on! Deciding when it was time to start using Quickbooks Self Employed It’s not totally perfect (which I get into in a bit), but I do depend on it daily and recommend it to any small business who needs a bit of help managing income and expenses. This is a product I’ve been using for years in my own business, and I can’t recommend it highly enough. Just a quick spoiler alert before you dig into this post: writing an in depth Quickbooks Self Employed review was easily one of the most fun articles I’ve written all month (and I do write a lot).

0 kommentar(er)

0 kommentar(er)